The latest Bloom Consulting Country Brand Ranking Trade edition is the first to reveal the impacts of Covid-19 on the performance of Nation Brands worldwide. Along with the global public health situation and its management, political decisions like Brexit, climate events and more have left their mark on this year’s results. Note, that this edition does not yet show the impact of the Russia-Ukraine war.

So, who has climbed and who has stumbled in this year’s Trade edition? In this article, we’ll look at the countries which have made it into the Top 10, and some of the biggest rises and falls.

Top performers

Despite Brexit, the United Kingdom (UK) knocked the United States of America (USA) off its perch for the first time since the inception of the Bloom Consulting Country Brand Ranking. The UK maintained a high Net FDI and CBS Rating © (AA), which compensated for the decrease in D2 – Digital Demand ©.

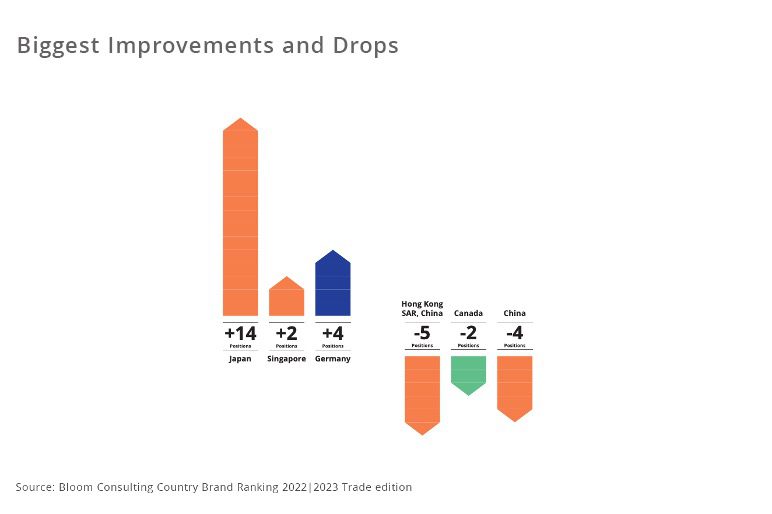

Also in Europe, France gained ground, and Germany climbed four positions in the global ranking thanks to the competitive and innovative nature of its economy. Europe is cementing itself as one of the most appealing regions for investors as this year’s results continue the trend seen in previous editions.

Along with the USA, Canada and Brazil are still in the global Top 10, seeing only minor shifts in their performance. While Canada improved for D2 – Digital Demand ©, it scored lower for Net FDI and social media performance.

In Asia, India is now in the lead, leaving China, Singapore and other traditional key players trailing behind. Its scores for D2 – Digital Demand ©, average Net FDI inflows and social media performance are remarkable. India has set the bar high for itself, which will likely encourage continued success in future.

As a region, Oceania reported only minor fluctuations. Australia is still firmly in the lead, having lost only one position globally despite very strict Covid-19 restrictions.

No countries from Africa made it into the global Top 10 this year or even the Top 25, and the Africa ranking experienced considerable fluctuations. Nigeria is now in the continental lead, pushing South Africa down to two.

Biggest rises and falls

Asia reported some of the most significant shifts. While it did not quite manage to squeeze into the Top 10, Japan is one to watch. Having gained 14 positions in the ranking, Japan made this year’s biggest leap, despite the decrease in its Net FDI and drop in CBS Rating ©. The country made great advances in terms of D2 – Digital Demand © and online performance. The Nation Brand is strong.

Also in Asia, Singapore is back on track after leaving the Top 10 in the last edition. Mitigation efforts must be working as Net FDI and D2 – Digital Demand © scores have improved. Singapore boasts the highest possible CBS Rating (AAA), which illustrates the relevance and strength of its Nation Brand.

It has been quite a dramatic time for China, which has to face defeat from India. While social media and online performance scores went up, the country had strong competition. Of course, the Covid-19 pandemic is also leaving its mark, which can start to be seen in the results for Net FDI and D2 – Digital Demand ©. No doubt, the effects will continue to be felt as material shortages are redefining the global supply chain and investment portfolios.

Hong Kong also lost out this year, dropping down by five in the ranking. The political and social events of 2019 – 2020 left their mark on D2 – Digital Demand ©. Net FDI, however, has not suffered.

For the full picture, download the complete report

The complete Bloom Consulting Country Brand Ranking Trade edition will reveal more on this year’s rises, falls and stable players. As ever, it is available to download for free. The report is designed to serve as a benchmark and assist brand managers and other stakeholders in the Nation Branding process. The World Economic Forum, World Bank and European Travel Commission use the data, too.

Download the complete Bloom Consulting Country Brand Ranking.

Published on 19.07.2022.