The latest edition of the Bloom Consulting Country Brand Ranking © in Trade reveals dynamic shifts in the performance of Nation Brands globally. This year’s results are influenced by ongoing geopolitical events, digital identity’s increasing importance, and evolving global trade dynamics. Notably, these shifts in rankings will provide a perspective of comparison in future rankings considering the recent geopolitical unrest in key global trade routes.

So, who has climbed and who has dropped in this year’s Trade edition? This article will highlight some of the notable movers in this year’s Trade edition of Bloom Consulting Country Brand Ranking ©.

Top Performers

Despite Brexit, the United Kingdom (UK) held off the United States of America (USA) for a consecutive year, marking the second time that a country other than the USA holds the first position since the inception of the Bloom Consulting Country Brand Ranking ©. The UK maintained a high Net FDI and CBS Rating © (AA), which compensated for the past decrease in D2 Digital Demand ©. Its multidimensional strategy keeps it at the forefront of the global economic stage.

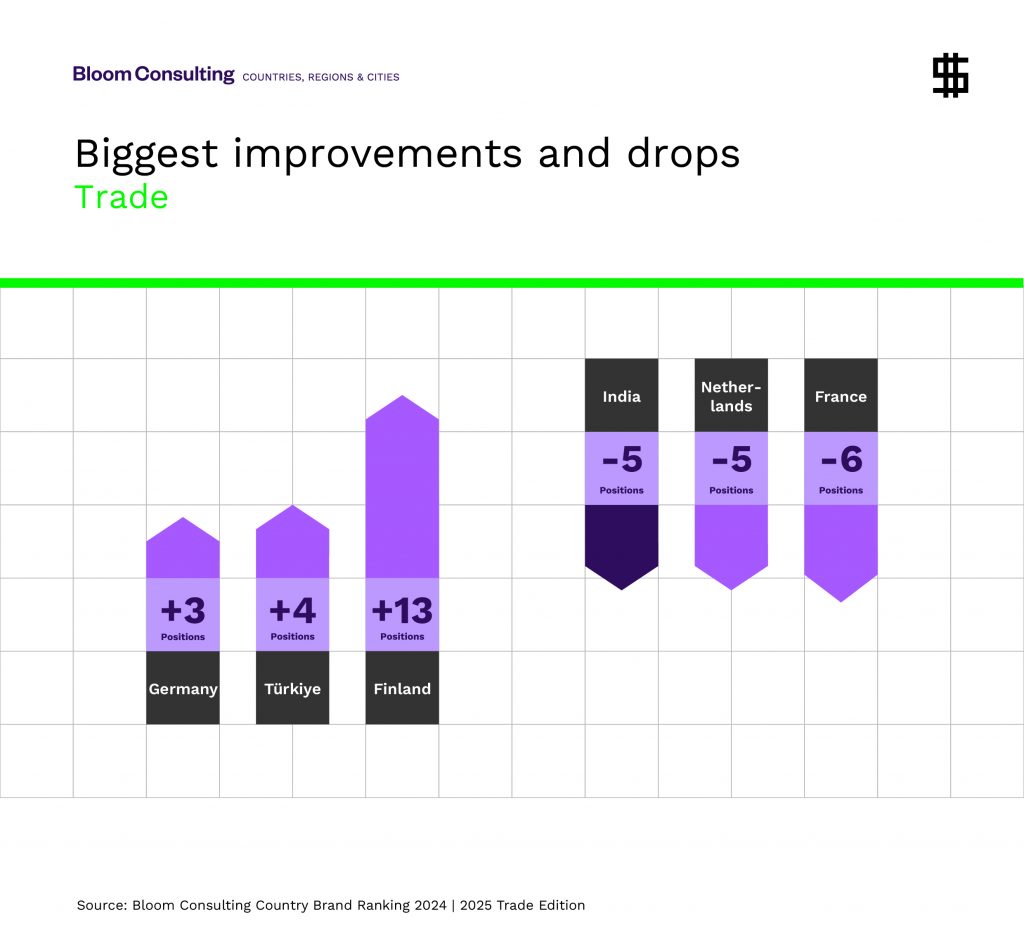

Germany careens up to second place with a three-position jump up the ranks, marked by its competitive economy, strong FDI, and excellent D2 Digital Demand ©. Türkiye also showcased one of the bigger jumps up the Top 20 by four positions, edging towards the Top 10 and supported by strong FDI and digital performance improvements.

Finland’s rise into the Top 25, by an impressive 13 rank increase, is propelled by consistent FDI, enhanced D2 Digital Demand ©, and a growing online presence, showcasing its commitment to a conducive investment environment. Finland breaks into the Top 20 in style, demanding respect for its Country and Nation Brand among other global leaders. While the UK continues to lead in Europe, Italy and Poland show improvements in trade metrics as well.

Biggest rises and falls

India experienced a drop, despite an improved score in FDI and social media, and saw a five-position drop due to a decrease in online presence, D2 Digital Demand ©, and CBS Rating © (AA). India’s decline underscores the need to adopt comprehensive policies that bolster its digital economy and global trade presence, ensuring it can capitalize on its sizeable market and diverse economic sectors.

France also sees a downturn of six positions, but the 2024 Olympic Games being held in Paris provide an opportunity to amend the D2 Digital Demand © dropoff of around -40% and decreased social media metrics that it faced this year.

The Netherlands, with a drop in CBS Rating © (AA), shares their European counterpart’s fate with a similar five-position drop down the rankings. This can be attributed to FDI showing a decrease from 2020-2022, however, the Dutch maintain the Global Top 20 position due to consistency and maintenance of remaining measured variables.

The Top 25 remain relatively stable, apart from drops from India, France, and the Netherlands. These drops demonstrate how a single variable, like a stark decrease in FDI or a decrease in D2 Digital Demand © can lead to a tumble down the ranks, even as other variables may remain stable.

China rises to the top in Asia, balancing rapid economic growth with sustainable digital integration. Singapore, Bangladesh and Mongolia also make notable improvements.

The Asian countries in the Top 20, Indonesia, Singapore, Japan, and China see slow but steady climbs of one to three ranks. South Korea enters the Top 25 this year, increasing the Asian presence in the Global elite.

In Africa, South Africa regains the top spot, driven by a surge in technology investment, while Burkina Faso and Senegal make impressive strides.

This year’s Bloom Consulting Country Brand Ranking © Trade Edition underscores the evolving global economic landscape, where digital and physical metrics play crucial roles in shaping the performance and perception of Nation Brands.

For the full picture, download the complete report: https://bit.ly/BloomCBRTrade

The complete Bloom Consulting Country Brand Ranking © Trade edition will reveal more about this year’s rises, falls, and stable players. As always, it is available to download for free. The report is designed to serve as a benchmark and assist brand managers and other stakeholders in the Nation Branding process. The World Economic Forum, World Bank, and European Travel Commission use the data, too.

Published on 11.06.2024.