As COVID-19 came down upon us, we launched a global research study, COVID-19: The impact on Nation Brands, presented during our recent webinar hosted by City Nation Place. This allowed us to gain a better understanding of the pandemic’s impact on nation brands and subsequently all dimensions of the Bloom Consulting Nation Brand Wheel©. Our main objective, with the help of our sister company, D2-Analytics, was to provide extensive data and clear guidance to steer countries down the road to recovery.

The study answered our question of how COVID-19 was impacting perceptions of countries and how the changing image of countries would further impact Nation Brand dimensions: tourism, investment, talent, exports, and general prominence. The study revealed that 68% of international respondents changed their perceptions based on how countries managed the crisis in terms of public governance. Two factors took priority in the eyes of global citizens when evaluating country crisis management performance; the time of response to the crisis and efficiency of actions taken by the government. The study isolates international perceptions and removes those of domestic opinion given the plausible skewing of data.

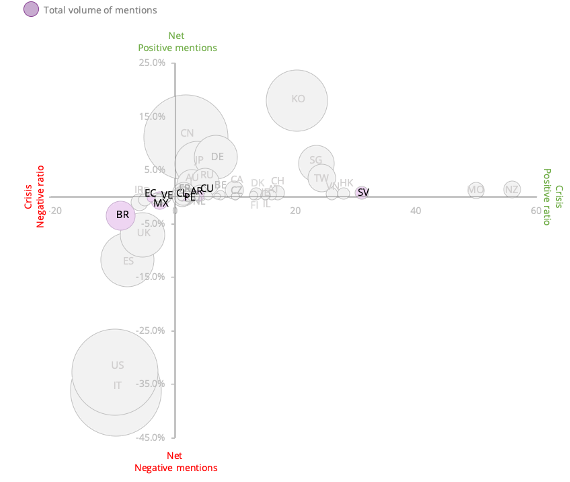

Global perceptions of Latin American countries’ response to COVID-19

Latin America was represented in this study by nine countries, each of which acquired the minimum critical mass of comments to be noteworthy: El Salvador, Cuba, Venezuela, Argentina, Peru, Chile, Ecuador, Mexico, and Brazil. As displayed in the graphic below, the bulk of Latin American countries represented in the study were clustered near to the intersection of the X-Y axis. Opinions however were polarizing given their proximity to the Y axis though maintaining low exposure in terms of Z axis (bubble size). This is to say that those countries which landed near the Y axis performed only moderately well when gauging their crisis ratio, especially given their lower exposure.

The matrix makes it clear that Brazil has received the worst crisis management ratio with a 9:1 (negative to positive mentions). Ecuador trails with a 4:1 ratio, followed by Mexico (3:1) and Venezuela (2:1).

On the other end of the spectrum, El Salvador championed the region in terms of crisis management ratio with 31 positive mentions for every 1 negative. That said, in looking at the quantity of mentions and Nation Brand exposure, Brazil’s volume of mentions was 17 times greater than that of El Salvador and Peru. In this case, a greater reach in mentions was negative for Brazil but in fact would have been advantageous for El Salvador had they achieved such reach.

Source: Bloom Consulting | D2 Analytics

Latin America displayed an interesting result in looking at the reasons behind positive and negative perceptions towards nations and their crisis management behaviours. When we take into consideration the top five reasons, both positive and negative, globally, there is no mention of social factors. However, Latin American perceptions are greatly influenced by factors which relate to social activities. Among the top five positive reasons we see social response commanding 17% of the share of mentions, likewise, social behaviour secures 8% of the negative reasons which affect respondents’ opinions of nations’ response to COVID-19. The importance placed on Latin American countries social response and social behaviour by the international community is greater than that of the cumulative importance placed on all of the other countries mentioned in the study.

What is Latin America’s Brand-Nought for COVID-19?

Having done away with the old methodology that suggests a 1:1 ratio is sufficient in gauging perception impacts on place brands, we developed the Nation Brand-Nought (or Place Brand-Nought but, to simplify, we’ll just call it the Brand-Nought), the red line that countries, regions and cities need to be aware of falling below or rising above to see an impact in perceptions.

We’ve concluded the need to calculate, compare, and monitor the Brand-Nought as it makes clear whether place brand touchpoints, such as COVID-19, are having an impact on the place brand and which dimensions are most aggressively being affected. Calculating the Brand-Nought allows for proper management of potential transactional value loss associated with a tarnished reputation as well as the opportunity to capitalize on a positive outcome, as we will see in the case of four Latin American countries.

In the case of Latin America, the regional Brand-Nought was -1.54 for COVID-19 crisis management whereas the global average was -1.80. What does this mean? Simply, it would take 1.54 positive perceptions to erase each negative perception. So, if Latin America’s crisis management ratio were to exceed its Brand-Nought, the region would see a positive impact in its brand.

Source: Bloom Consulting | D2 Analytics

Note: Results vary by country

As we mentioned, not every dimension is affected in the same way. The Brand-Nought affects willingness to visit, live/work, study and buy from at a different level of intensity. In accordance with the global average, the dimension which is affected most greatly and is determined the most sensitive to crisis management perceptions is talent (live/work and study). The dimensions of tourism and exports are far less affected and in turn more resilient.

In comparing the results of Latin American countries in terms of crisis management performance against their respective Brand-Nought, we find a range of winners and losers. The general overview would rank the countries as follows: El Salvador, Cuba, Venezuela, Argentina, Peru, Chile, Ecuador, Mexico, and Brazil. This is to say that El Salvador outperformed its regional competitors and scored most positively by way of crisis management perceptions beyond its Brand-Nought.

Source: Bloom Consulting | D2 Analytics

Given the general overview, we assess the countries’ average performances however, as mentioned above, dimensions are affected differently and therefore each puts forth a different Brand-Nought. Argentina and Venezuela for example could be said to perform well given their positive ranking, yet both countries are two of the most volatile in terms of dimension impact. Countries such as these must heed caution as there is a possibility of transactional value loss by area of focus, which, if not addressed, may in fact begin to tarnish the overarching nation brand.

This article was originally posted on the City Nation Place website.