The findings of the Travel & Tourism Development Index (TTDI) which measures 117 economies on a range of tourism and travel-related indicators and policies, has been published by the World Economic Forum (WEF) today. The WEF describes this addition as an “evolution” to the previous Tourism and Travel Competitiveness Index.

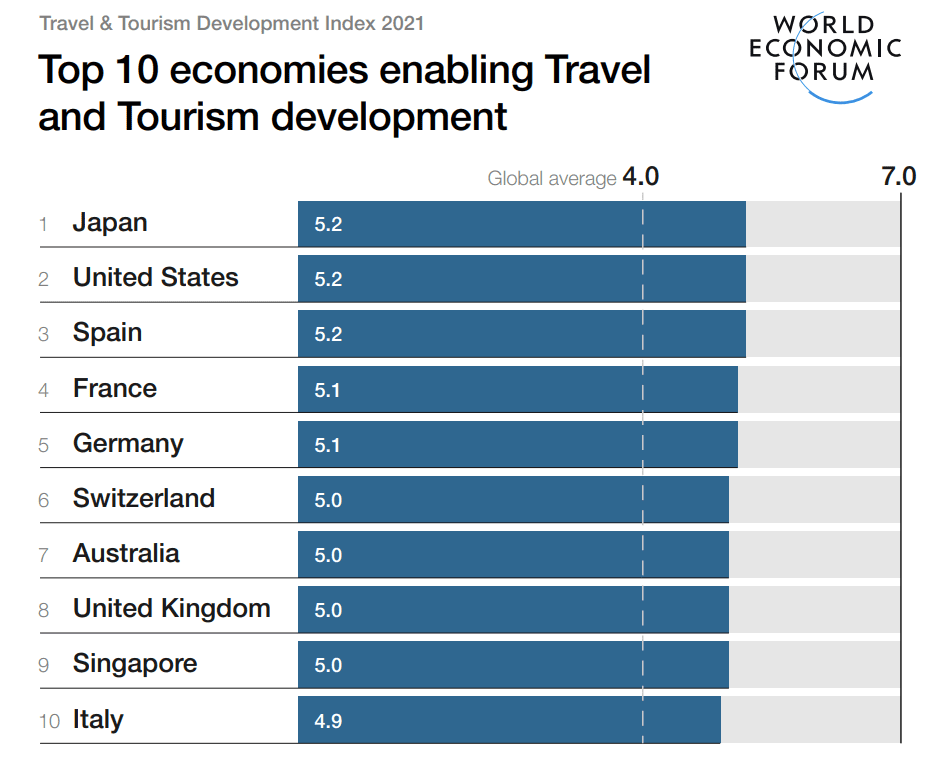

Every two years, the WEF publishes in-depth analysis as well as an index that gives countries a score and overall ranking and serves as a critical benchmarking tool for the T&T sector. Japan topped the ranking this year, with the United States coming in second; Spain third, and the United Kingdom in eighth position.

Bloom Consulting, a member of an advisory group and data partner for the report, believes the outcomes will be highly anticipated by the industry because tourism and travel has changed in unprecedented ways since the publication of the TTDI’s predecessor, the Travel & Tourism Competitiveness Index (TTCI) 2019.

“The climate crisis, the pandemic and now the outbreak of war in Europe continues to disrupt and impact the recovery of the industry. What made an economy competitive in the past, isn’t necessarily what will make it competitive and sustainable for the future. As such, policies and strategies need to evolve and this report provides much-needed direction,” said Jose Torres, CEO of Bloom Consulting.

See which countries scored in the top 10 of the WEF TTDI.

New criteria for a new era

Economies are measured using five subindexes and 112 individual indicators which covers a range of criteria that takes into account “business, safety and health conditions, infrastructure and natural resources as well as, environmental, socioeconomic and demand pressures”.

This year, criteria used to measure the long-term development drivers of tourism and travel in economies has been updated to reflect the changing market conditions and include a greater focus on sustainability and resilience. SOCIOECONOMIC RESILIENCE AND CONDICTIONS, NON-LEISURE RESOURCES AND T&T DEMAND PRESSURE & IMPACT pillars are all new to the 2021 edition of the TTDI.

“The need for T&T development has never been greater as it plays a critical role in helping the global economic recovery by supporting the livelihoods of some of the populations hardest hit by the pandemic.” WEF

Key outcomes

Uneven T&T recovery

With the accessibility of vaccines in Western countries, strong government spending and an easing of travel restrictions amongst many Western countries, the T&T industry in the developed world is on the road to recovery.

Whilst international arrivals were still 67 per cent below pre-pandemic levels according to the latest outlook from the United Nations World Tourism Organization (UNWTO), tourist arrivals increased by 4.0 percent in 2021 and numbers in January 2022 rose even further.

While momentum is gathering pace with tourists eager to travel once again, experts say that international arrivals may not return to pre-pandemic levels until 2024 at the earliest. Countries, for instance, like Australia and New Zealand announced only recently that borders were reopening to international travellers. Further, the unprecedented war in Ukraine has led to increased uncertainty and a rise in the cost of living which may lead to less demand for the travel sector.

On a global perspective the recovery of the T&T sector “remains slow, uneven and fragile” due to many factors including the limited access to vaccines in emerging and developing economies and an inclination by some tourists to be more sensitive to health and safety conditions, sticking with destinations with widespread vaccination rates and better healthcare services. In many parts of the world, many Covid-related travel restrictions and mask mandates are still in place.

The World Bank predicts that emerging markets and developing economies (EMDEs) will not return to pre-pandemic tourism activity until after 2023, and 80 percent of tourism reliant EMDEs were below their 2019 economic output at the end of 2021.

Tourism reliant EMDEs face a significant and urgent need to close this gap because their entire economy depends on it. “Investing in T&T could not only mitigate the impact of the pandemic but also improve socioeconomic progress and resilience,” the report said.

Going forward, the T&T sector must work to improve “ the distribution and promotion of natural, cultural and non-leisure assets and activities; the availability of quality transport and tourist service infrastructure; the degree of international openness; and favourable factors such as (increasingly important) ICT readiness and health and hygiene,” the report stressed.

As a result of changing market conditions and increased uncertainty, the public and private sectors are “continuously reviewing their tourism strategies and policies to bolster recovery” whilst the industry overall remains “vulnerable to socioeconomic conditions and global risks”.

Sustainability and resilience:

Climate and other environmental issues are a growing risk for many T&T economies with the report warning the sector is “increasingly tied to their ability to manage and operate under ever greater ecological and environmental threats.” Further, results captured from The World Economic Forum’s Global Risks Report 2022 survey confirmed environmental risks represent half of the top 10 global risks.

Even before the pandemic, sustainability issues such as overcrowding, environmental degradation caused by mass tourism, and the liveability for residents in highly visited cities like Amsterdam or Barcelona were mounting.

Whilst the initial lockdowns in 2020 forced a complete stop to the actions causing environmental pressures, new smarter ways of approaching sustainable growth are needed as the global industry works to recover.

“Economies that have sustainable tourism strategies such as the protection of natural assets, longer stays for tourists and the promotion of less populated areas will have long-term competitive advantages because the whole world is moving, slowly but surely, into more sustainable, less carbon intensive ways of operating. Some of the trends we saw during the pandemic, like the shift to nature trips over cities, we think will stay for the long-term,” Torres said.

Changing dynamics of tourism

The pandemic has created new opportunities and shifted consumer preferences – many economies will notice and adapt accordingly. According to the UNWTO Panel of Experts, the major trends driving the T&T recovery include “domestic tourism, travel close to home, open-air activities, nature-based products and rural tourism”.

Over the last two years, nature-related segments saw a 20.8 percent average growth in Digital Demand as people flocked to nature destinations, such as parks and mountains, that were safer and more accessible during the pandemic. In fact, some countries in nature-based and rural tourism markets have been able to grow beyond pre-pandemic levels.

Influenced by the restrictions and travel policies during the pandemic domestic travel rose which saw an average spending increase from 50.8 per cent in 2019 to 62.6 per cent in 2020 among economies ranked in the TTDI. Conversely, the business travel segment declined as people moved to zoom and remote work.

“Reading this report demonstrates that the world has changed and what consumers wanted in the past, will not be what they want in the future. It has been a hugely unsettling time but the industry can also look to the opportunities and the new sources of growth that are starting to take shape as outlined in this report. Nation Brands need to focus on these opportunities whilst realising that uncertainty right now is the norm,” Torres said.

To read the full report visit www.weforum.org.

Published on 24.05.2022.